The US-listed firm and particular person executives are accused of false and deceptive filings and statements that allowed for a synthetic inflation of inventory costs

A banner for Coupang hangs outdoors the New York Inventory Change on Wall Avenue in New York to mark its IPO on March 1, 2021. (AP/Yonhap)

Coupang is going through a class-action lawsuit from US shareholders for failing to reveal info on its disastrous knowledge breach.

In line with the US District Court docket for the Northern District of California, Joseph Barry, a shareholder of Coupang’s father or mother firm, Coupang Inc., filed a lawsuit in opposition to Coupang, its CEO Bom Kim, and Chief Monetary Officer Gaurav Anand on Thursday (native time).

Legal professional Laurence Rosen, who represents Barry on this case, argued within the criticism that the defendants violated the regulation and did not disclose key info that led to plummeting shares, inflicting monetary hurt to buyers.

“A danger disclosure concerning cyber safety contained within the 2024 Annual Report was materially false and deceptive on the time it was included by reference within the Q2 2025 Report. It remained false and deceptive on the time it was included by reference within the Q3 2025 Report. By the point the Q3 2025 Report was filed with the [Securities and Exchange Commission], the previous worker who had retained entry to Coupang’s inner methods, had maintained illegal entry to Coupang buyer info for almost six months, demonstrating the fabric inadequacy of Coupang’s cybersecurity defenses,” the criticism alleges.

A mannequin of a buying cart crammed with packages with the Coupang brand within the background. (Reuters/Yonhap)

The criticism additional says that Coupang solely submitted a Type 8-Ok — a regulatory submitting used to tell shareholders of firm occurrences related to their investments — after the market closed on Dec. 16, admitting that the info breach had occurred and that it turned conscious of the incident on Nov. 18, addressing how the belated response reveals that the corporate violated its accountability to inform shareholders of the breach inside 4 working days.

Rosen additional defined that the next wave of media studies, the resignation of the CEO of the Korean subsidiary, and criticism from political circles, together with the South Korean president himself and lawmakers within the Nationwide Meeting, led to a cumulative decline within the firm’s inventory worth, leading to losses for buyers.

The go well with seeks to find out if defendants “acted knowingly or recklessly in issuing false and deceptive SEC filings and public statements” and “whether or not the costs of the Firm’s securities in the course of the Class Interval had been artificially inflated due to the Defendants’ conduct complained of herein.”

Coupang’s inventory worth fell 18% from US$28.16 on Nov. 28, the day earlier than the corporate formally introduced the info breach, to US$23.20 on Dec. 19.

Individuals affected by this incident are eligible to hitch the category motion by Feb. 17, 2026, so the variety of plaintiffs is predicted to develop even additional.

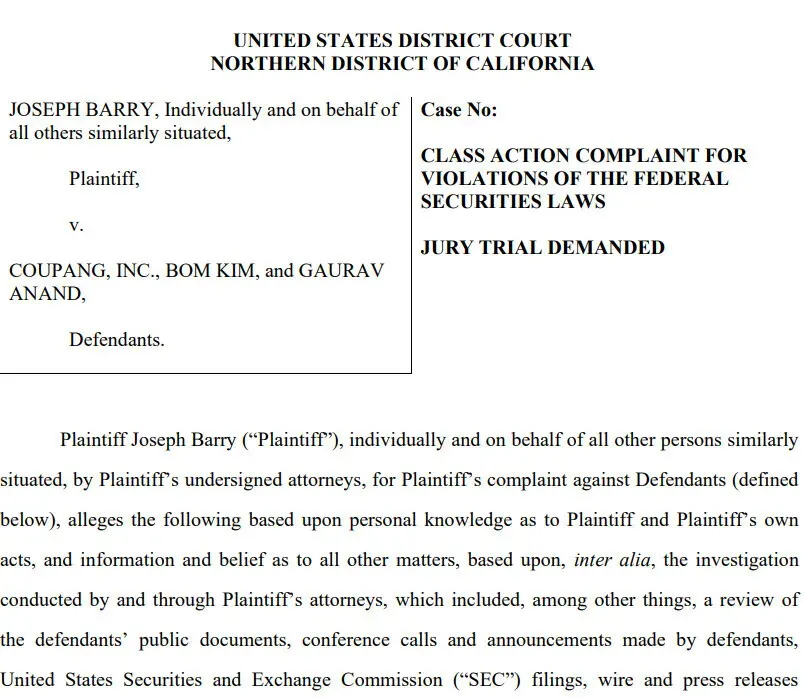

A portion of the category motion criticism filed in opposition to Coupang.

By Jung Yu-gyung, employees reporter

Please direct questions or feedback to [english@hani.co.kr]