[ad_1]

The business actual property market within the US and Europe is displaying early indicators of a rebound, supported by restricted provide after a development slowdown throughout COVID-19 and easing borrowing prices, portfolio managers stated at ASK 2025 on Oct. 30.

Workplaces, hit hardest by excessive rates of interest and pandemic-era social distancing, has begun to ship optimistic returns for the reason that first quarter of this 12 months after their valuations plunged by as much as 50% since 2022.

“Now’s a compelling entry level for the US actual property market,” stated Jonathan Epstein, managing companion at BGO, an actual property funding agency.

STRUCTURAL SHIFT

3650 Capital stated the true property market is going through a structural shift with the AI evolution and automation, including that know-how innovation will widen the dispersion of returns.

“3650 believes the US business actual property is experiencing enter demand shift on par with these of the commercial revolution,” Justin Kennedy, co-founder and managing director on the US business actual property laon servicing firm.

The widening hole in returns is clear not solely throughout asset courses, but additionally inside particular person segments — even by zip code in the identical metropolis.

Kennedy cited two Manhattan workplace towers — Worldwide Plaza and Park Avenue Tower –located lower than a 30-minute stroll aside.

Worldwide Plaza is valued at about $190 per sq. foot, in contrast with roughly $1,200 per sq. foot for Park Avenue Tower. Worldwide Plaza boast marquee tenants, together with JPMorgan, Citadel, Carlyle Group and Blackstone.

“Huge return dispersion arises from micro market distinctions,” he stated.

The hole in residual land values between prime and lower-tier properties has additionally widened considerably

“AI and automation will drive the subsequent wave of volatility in logistics actual property,” Kennedy stated throughout a presentation titled “Evolving applied sciences drive efficiency volatility and dispersion.”

3650 Capital advises buyers to undertake “alpha-focused, property-level concentrating on” slightly than broad, beta-style allocation.

Epstein at BGO echoed Kennedy, saying: “Worth dislocation and return dispersion makes asset choice key.”

TRANSITIONAL LENDING

With demand for non-bank credit score anticipated to rise, transitional lending within the business actual property sector is about to broaden, in line with Wellington Administration and PIMCO.

A rebound in actual property transaction quantity and refinancing wants will propell development in personal credit score, notably transitional loans, whereas conventional lenders pull again amid tightening rules, stated Nuveen.

Of almost $6 trillion of business actual property debt within the US, about $1.9 trillion of loans within the US business actual property sector are looming to mature via 2027, PIMCO estimated.

“A $1.9 trillion refinancing wall has created an excellent atmosphere for personal lenders to step in,” stated Ravi S. Anand, head of personal actual property debt at Wellington.

Transitional lending is a type of debt financing that gives debtors with funds to execute on transitional enterprise plans and redevelopment alternatives.

Anand famous that transitional lending is predicted to supply secure and constant revenue with as a lot low threat as that of senior loans.

In Europe, a scarcity of depth in capital markets, in comparison with the US with much less competitors for transactional loans given differing jurisdictions and country-specific rules, coupled with considerably smaller business mortgage-backed securities market relative to the US, PIMCO stated.

The actual property credit score market has been closely reliant on a extremely fragmented banking system in Europe, PIMCO stated.

“These components drive a much less environment friendly market and create alternatives to unlock relative worth versus the US,” stated PIMCO.

PIMCO stated Europe can be extra engaging than the US for transitional mortgage suppliers.

“Whereas relative worth can shift, we imagine Europe at the moment gives a extra engaging unfold atmosphere than the US,” PIMCO stated. “We see engaging relative worth in transitional loans,” PIMCO stated.

Nuveen stated that business actual property debt has the potential to ship sturdy risk-adjusted and absolute return, including that the true property cycle in Europe is at or near bottoming out.

“Lending in opposition to these decrease values gives an elevated stage of safety to the lender relative to the latest previous,” Nuveen stated.

Following worth declines, loan-to-value (LTV) ratios have correspondingly elevated from 50-60% previous to 2022, it added.

“SILVER TSUNAMI”

The residential sector, together with pupil and senior housing, stay engaging amid persistent provide shorages, urbanization tendencies and demographic shifts.

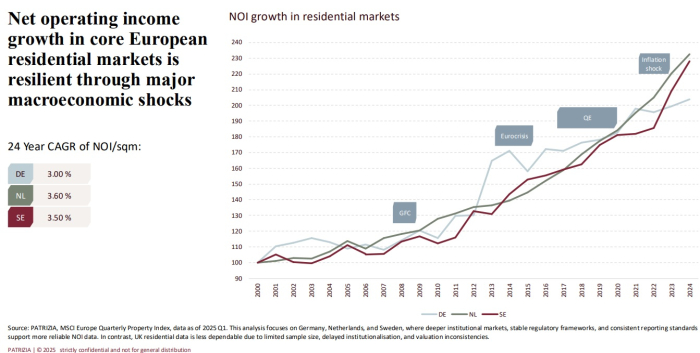

“Present development exercise is declining, mirroring the downturn seen through the international monetary disaster between 2007 and 2010,” stated Felix Speetzen, director and fund supervisor at Patrizia, in a presentation concerning the European actual property market outlook. “Seize a beautiful market entry window.”

Since late 2024, European capital has returned to the residential sector within the area, with a powerful focus within the UK, it stated,

Within the US, the inhabitants aged 80 and older is predicted to develop by 93% via 2040, BGO stated, describing the pattern as “silver tsunami.”

INDUSTRIAL PROPERTIES

Underneath the Trump administration’s protectionist insurance policies, the onshoring of key industries, together with pharmaceutical amenities, semiconductors vegetation and shipyards can even underpin the nation’s industrial actual property market, BGO stated.

[ad_2]