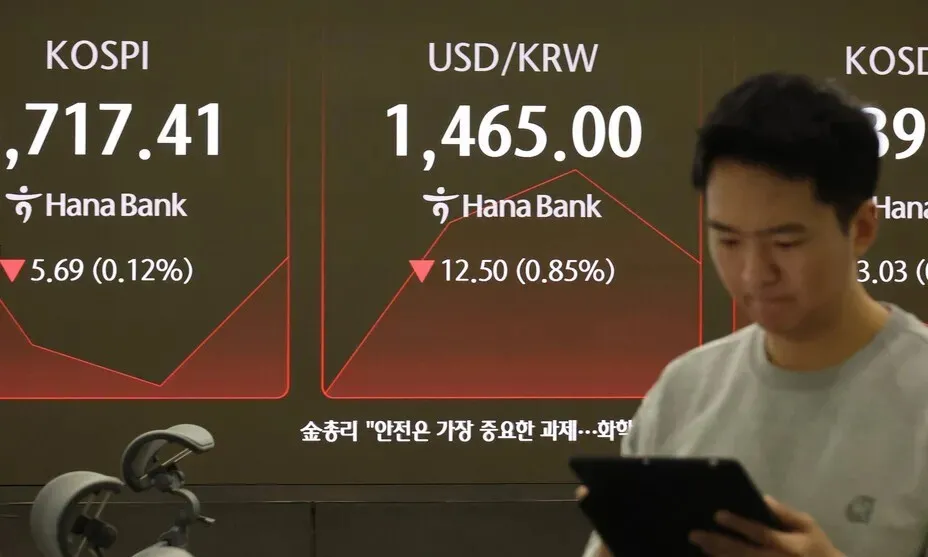

Displays in Hana Financial institution’s buying and selling room in downtown Seoul present the figures for the KOSPI and won-to-dollar change fee on Jan. 15, 2026. (Yonhap)

Regardless of the South Korean authorities’s greatest efforts, the won-dollar change fee continues to soar, prompting the secretary of the US Treasury to defend the change fee. No US Treasury chief has ever made a verbal intervention relating to the depreciation of the received, which means that the transfer was made out of worry {that a} leap within the won-dollar change fee may probably harm Korean investments within the US.

Whereas the change fee fell sharply after the feedback, it has since risen as particular person traders continued to buy US {dollars}. To counter this phenomenon, the South Korean authorities is reviewing further macroprudential measures, comparable to managing capital flows.

Following a gathering with Korea’s minister of financial system and finance, US Secretary of the Treasury Scott Bessent on Wednesday posted on X, previously Twitter, that “the latest depreciation of the Korean received [. . .] isn’t in step with Korea’s robust financial fundamentals.” This marked the primary time a US Treasury secretary publicly made a put up on their official social media account mentioning the won-dollar change fee.

The US Treasury additionally launched a readout of the assembly which learn, “Secretary Bessent emphasised that extra volatility within the international change market is undesirable, and reaffirmed that Korea’s robust financial efficiency, particularly in key industries that help America’s financial system, make[s] it a important companion for the USA in Asia.”

As a substitute of following its custom of monitoring potential rigging of foreign money values by labeling commerce companions as “foreign money manipulators,” the US Treasury is now informally intervening to understand the foreign money of its companions.

The stakes of the US$350 billion funding package deal that South Korea has promised to the US seem to have influenced latest discourse.

“What we conveyed to the US Treasury was that if volatility within the international change market will increase, there could possibly be vital constraints on implementing the promised annual investments of as much as US$20 billion within the US,” defined Choi Ji-young, the deputy minister for worldwide affairs with South Korea’s Ministry of Economic system and Finance, in a briefing Thursday.

“There was an change on the working-level relating to the state of affairs in Korea’s international change market, and we agreed that South Korea and the US needed to launch a united message,” Choi stated.

Following Bessent’s remarks, the won-dollar change fee closed at 1,464 received at 2 am KST on Thursday, down 9.7 received from the earlier buying and selling day’s after-hours closing value. Nevertheless, when the home market opened at 9 am, demand from home traders eager to revenue on a low-price greenback shopping for alternative pushed the speed again up, briefly breaking the 1,470 received stage.

US Treasury Secretary Scott Bessent’s put up on the social media platform X.

“There was a particularly robust greenback shopping for demand as quickly because the market opened. It was largely led by securities companies’ investments abroad. Overseas traders appear to agree with Bessent’s evaluation that South Korea’s fundamentals and the present change charges aren’t in sync, whereas home traders seem to view this as a bargain-buying alternative,” defined Choi.

“Speculative demand in South Korea appears to be the catalyst for this vicious cycle we discover ourselves in,” the deputy minister continued.

The federal government communicated that if this pattern have been to proceed, it might result in macroprudential measures, comparable to capital controls. The federal government beforehand established three macroprudential measures, which embrace imposing international foreign money debt levies on banks and different monetary establishments to curb the speedy influx and outflow of world capital, after the 2008 world monetary disaster.

“The measures have been created when the received was stronger, so we now have to design new insurance policies acceptable for the present state of affairs,” Choi famous.

By Shin Min-jung, employees reporter; Kim Yoon-ju, employees reporter

Please direct questions or feedback to [english@hani.co.kr]